Last Thursday, September 24, 2020, the Federal Government published Supplementary Law ("LC") No. 175/2020, which established new rules for calculation and reporting of the Tax on Services of Any Nature ("ISS") and created a national standard for the accessory obligations of the ISS ("National Standard") for some specific services usually rendered by factorings, health plan administrators, funds, consortiums, cards and companies of the means of payment sector.

The ISS, a tax instituted by each Municipality and by the Federal District ("DF"), is usually accompanied by several accessory obligations, such as payment forms, withholding statements, collection statements, registration of takers and providers, among other formalities. These accessory obligations are also instituted by each entity, that is, there is an infinity of different models and rules in the Country considering that, currently, Brazil has 5,570 (five thousand, five hundred and seventy) Municipalities and the Federal District.

With the change determined by the Federal Government, the ISS will be assessed through an electronic system of unified standard throughout the national territory ("Standard Electronic System") to be developed by the taxpayers themselves, based on the determinations of the Management Committee of the Accessory Obligations of the ISSQN ("CGOA"). In addition to being ascertained, the ISS shall also be declared by such system.

The National Standard and the Standard Electronic System still depend on regulations to be implemented. With its implementation, there should be a substantial reduction in the operationalization of accessory obligations for companies and entrepreneurs, in addition to facilitating the inspection activity of the Municipalities and Federal District and performing a better distribution of revenues among the Municipalities of the place of establishment of the service provider and the domicile of the service acquirer.

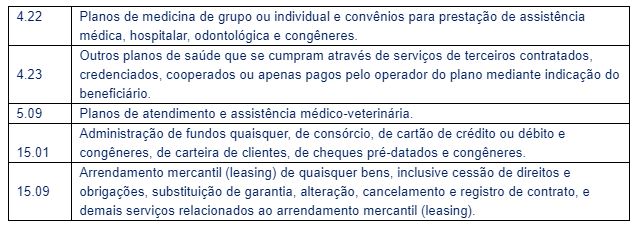

It is important to note that the National Standard only applies to the following items of LC n° 116/2003 ("List of Services"):

In the Standard Electronic System, the taxpayers that render these services may identify the ISS rates for each Municipality and Federal District, the statements via electronic files required by the entities and the bank data for settlement of the ISS, which will now occur exclusively through bank transfer under the Brazilian Payment System ("SPB"), therefore the taxpayer will be able to ascertain and declare taxes more easily. Likewise, the Municipalities will have easier access to the database provided by taxpayers for the exercise of their inspection activities.

Three other important novelties brought by LC no. 175/2020 are: (i) the waiver of the issuance of Invoices for the services listed in items 15.01 and 15.09; (ii) the express prohibition for Municipalities and the Federal District to impose on taxpayers not established in their territory any other accessory obligations not provided for in LC No. 175/2020, such as registrations, licenses and permits; and (iii) the ISS is now updated by the SELIC as from the 1st (first) day of the month subsequent to the month of its normal due date and until the month prior to the month of payment, when a rate of 1% (one percent) is applied.

Considering that as of the implementation of the Standard Electronic System the responsibility for the maintenance of the updating of the information related to the ISS will be of the Municipalities, we understand that there is also an advantage for the taxpayers as to the reduction of mistakes due to human failure in the identification and interpretation of the tax legislation, which we know to be, many times, of difficult location and interpretation.

On the other hand, we suggest taxpayers to be careful when entering tax information by the Municipalities and Federal District in the Standard Electronic System, since, should the information entered therein imply an increase of rates or creation of new tax bases for the ISS, these should respect the constitutional principles of anteriority. Furthermore, there may be tax impacts when rules are altered or revoked by the Municipalities and Federal District over time, as well as for those taxpayers that have or intend to file Special Regimes requests.

The ISS shall be collected in the Standard Electronic System until the 15th (fifteenth) business day of the month subsequent to the occurrence of the taxable events and the ISS statement sent until the 25th (fifteenth) business day of the month subsequent to the occurrence of the taxable events.

There is still "a lot of water to flow" as to the interpretation and reach of this LC, especially due to the need to create the Standard Electronic System, still pending, the duties attributed to the Municipalities and to the Federal District as to the constant update of the Standard Electronic System and as to the distribution of revenues among the Municipalities, as well as, still, as to the need to create an agreement, adjustment or protocol between the Municipalities and the CGOA for the regulation of the National Standard.

BTLAW's Tax Planning and Consulting team is available to assist you with further information on this topic: [email protected].