The Federal Government has adopted several measures in the tax, customs and social security spheres to reduce the economic impacts of the Coronavirus to Brazil. These acts are periodically updated and summarized by our tax team.

See below our summary of the Tax, Customs and Social Security measures, divided into topics:

Tax Measures:

- Presentation of Documents: The Normative Instruction (IN) of the Federal Revenue of Brazil (RFB) n° 1.931/2020 suspended, until May 29, 2020, the need for taxpayers to submit original documents or certified copies for the request of services with the RFB. Documents in plain copy or electronic copy obtained by means of scanning will now be temporarily accepted, in view of the fact that the services at the RFB's premises are reduced, being carried out primarily by virtual means.

- Debt Clearance CertificatesThe RFB and the Attorney General of the National Treasury (PGFN), through Joint Ordinance RFB and PGFN No. 555/2020, extended the validity of the Debt Clearance Certificates related to Federal Tax Credits and Federal Active Debt (CND) and of the Positive Certificates with Negative Effects of Debts related to Federal Tax Credits and Federal Active Debt (CPEND) for 90 (ninety) days.

- Collection of Tax DebtsRFB determined the suspension, until May 29, 2020, of electronic notices of collection and summons to pay taxes through Ordinance RFB no. 543/2020. Likewise, the PGFN, through Ordinance of the Ministry of Economy (ME) no. 103/2020, also suspended collection acts and the forwarding of active debt certificates for extrajudicial protest for the next 90 (ninety) days. Such suspensions also apply to social security debts.

- Income Tax Return of IndividualsThe deadline for filing the Individual Income Tax Return, previously set for April 30, 2020, has been postponed to June 30, 2020. This extension of two (2) months was granted by Normative Ruling (IN) No. 1924/2020, subsequently amended by IN No. 1930/2020, in response to taxpayers' reports on difficulties in obtaining their Income Tax Returns during the Coronavirus crisis.

- Final Estate DeclarationThe deadline for filing the Final Estate Return related to the taxable events of calendar year 2019, which was originally set for April 30, 2020, was changed by IN RFB No. 1,934/2020 and exceptionally extended to June 30, 2020.

- Declaration of Definitive Departure from the CountryThe deadline for filing the Country Definitive Departure Statement and for paying the taxes resulting from the individual's departure or absence in the 2019 calendar year, which was originally set for April 30, 2020, is exceptionally extended to June 30, 2020, as authorized by IN RFB no. 1,934/2020.

- DrawbackMP no. 960/2020 extended for one year the term of suspension of tax payments provided for in the Drawback concession acts that have already been extended for one year and would end in 2020. The tax relief, which begins with a suspension of taxation and may be converted into exemption, affects, at the federal level, the II, the IPI, and the PIS and COFINS contributions.

- DCTF and EFD-Contributions: The deadline for filing the Federal Tax Debts and Credits Statement ("DCTF") and the Digital Tax Bookkeeping of the Contribution to PIS/PASEP, COFINS, and Social Security Contribution on Revenues (EFD-Contributions) was extended by IN RFB No. 1932/2020.

The DCTFs to be transmitted until the 15th (fifteenth) business day of April, May and June 2020 are extended to the 15th (fifteenth) business day of July 2020.

The EFDs-Contributions that would be transmitted until the 10th (tenth) business day of April, May, and June 2020 are extended to the 10th (tenth) business day of July 2020.

- ECDAccording to Normative Ruling (IN) no. 1950/2020, the deadline for the transmission of the Digital Bookkeeping Statement ("ECD") related to the calendar year of 2019 was extended to the last business day of the month of July, 2020, including in the cases of extinction, incorporation, merger and spin-off of the legal entity.

- Import TaxThe Federal Government has authorized the reduction to 0 (zero) of the ad valorem rates of the Import Tax, until September 2020, on the import of medical-hospital products listed in CAMEX Resolutions No. 17, 22, 28, 31, 32, 33, 34 and 44 of 2020.

- IOF-CreditThe IOF-Credit rates applicable to transactions entered into between April 3, 2020 and July 3, 2020 related to loans, opening of credit, discounts, including sales to factoring companies of credit rights arising from installment sales, advances to depositors, financing and excesses of credit limits referred to in items I, II, III, IV, V, VI and VII of the heading and in §15 of Art. 7 of Decree no. 6306/2007, as well as the additional IOF rate dealt with in §5 of Art. 8 of said rule. This change was promoted by Decree 10305/2020, which also established the same reduction for new incidences of IOF-Credit on these transactions and on transactions not settled on the due date referred to in paragraph 2 of Art. 7 of Decree 63306/2007.

- IPIThe Federal Government has also authorized the reduction to 0 (zero) of the IPI rates until September 2020 for domestically produced or imported goods listed in Decrees Nos. 10,285/2020, 10,302/2020 and 10,352/2020.

- PIS/COFINSAccording to ME Ordinance No. 139/2020, the deadlines for the collection of PIS/COFINS related to March and April 2020 are postponed to the due dates of such contributions in July and September 2020, respectively. In addition, Decree 10318/2020 reduced to zero, until the end of September 2020, the PIS/COFINS rates, domestic and import, on zinc sulfate for medicines used in parenteral nutrition, as specified.

- Administrative ProcessesAccording to Ordinance ME No. 103/2020 and RFB Ordinance No. 543/2020, the terms for taxpayers' defense in administrative proceedings for collection of the federal past-due liability, including social security debts, were suspended for ninety (90) days, and the terms for performing procedural acts within the scope of the RFB and for the RFB to issue electronic rulings with analysis of merit in requests for refunds, reimbursement and reimbursement, and offsetting statements were suspended until May 29, 2020.

In addition, Ordinance PGFN no. 7.821/2020 also suspended for ninety (90) days the deadlines for the filing, opposition and appeal against the decision rendered in the scope of the Administrative Procedure for the Recognition of Liability (PARR), for the filing of a statement of non-compliance and appeal in the scope of the exclusion process of the Special Program of Tax Regularization (PERT), for the early offer of guarantee in tax enforcement, for the filing and appeal against the dismissal of the Request for the Review of Enrolled Debt (PRDI) and for the filing for protest of overdue debt certificates.

- Installment payment programsME Ordinance No. 201/2020 extended the due dates for monthly installment payments relating to the installment payment programs administered by the RFB and PGFN, and the installment due dates are extended until the last business day of (i) August 2020, for installments falling due in May 2020; (ii) October 2020, for installments falling due in June 2020; and (iii) December 2020, for installments falling due in July 2020.

Moreover, pursuant to CGSN Resolution no. 155/2020, the due dates of the monthly installments related to the installments of taxes ascertained under Simples Nacional and the System for Collection in Monthly Fixed Amounts of the Taxes covered by Simples Nacional ("Simei") are extended until the last business day of the month of (i) August 2020, for the installments due in May 2020; (ii) October 2020, for the installments due in June 2020; and (iii) December 2020, for the installments due in July 2020.

- Renegotiation of debtsME/PGFN Ordinance No. 9,924/2020 established conditions for the so-called extraordinary transaction in the collection of the federal past-due liability debt, which adhesion period will remain open until June 30, 2020.

This is the possibility of renegotiating debts recorded in the federal past-due liability roster, including social security debts, through an adhesion transaction on the REGULARIZE platform(www.regularize.pgfn.gov.br).

The adhesion presupposes the payment of an down payment of at least 1% (one percent) of the total amount of the debt in up to 3 (three) installments, as well as the payment of the remaining debt in up to 81 (eighty-one) installments for legal entities or 142 (one hundred and forty-two) installments for natural persons, individual businessmen, micro companies (ME), small size companies (EPP), Teaching Institutions, Santas Casas de Misericórdia, Cooperative Societies and other organizations of the civil society, being the first payment of the other installments postponed to the last business day of the third month consecutive to the month of adhesion. For social contributions, there is a limitation of fifty-seven (57) installments.

The extraordinary transaction set out in the ME / PGFN Ordinance does not exclude the possibility of adherence to the other transaction modalities set out in PGFN Ordinance No. 9,917/2020, resulting from Law No. 13,988/2020.

- Simples NacionalNew alteration in the Simples Nacional payments was promoted by the National Simples Manager Committee Resolution (CGSN) n° 154/2020. According to the Resolution, the payments of Federal Taxes due in April, May and June 2020 were extended to October, November and December 2020, and the payment of State and Municipal Taxes due in April, May and June 2020 were extended to July, August and September 2020.

Moreover, CGSN Resolution no. 155/2020 provides for the extension of the deadline in installment payment programs under the Simples Nacional, as we have already commented above, and, furthermore, that the MEs and EPPs enrolled in the CNPJ during the year 2020 may formalize the option for the Simples Nacional, in the condition of companies starting their activities, within 30 days, counted from the last registration deferment, be it the municipal or state one, as long as it does not exceed 180 days from the opening date in the CNPJ.

- TelecommunicationsMP no. 952/2020 extended to August 31, 2020 the deadline for payment of the following taxes levied on the telecommunications sector, as established herein (i) TFF - Operating Inspection Fee; (ii) CDICN - Contribution for the Development of the National Cinematographic Industry; and (iii) CFRP - Contribution for the Promotion of Public Broadcasting. The MP also enabled the installment payment of the taxes in up to 5 (five) installments with SELIC adjustment only.

- Taxation of the Exchange Variation of Hedge for Financial InstitutionsMP no. 930/2020 established that, as of 2021, the exchange variation of the portion with risk coverage (hedge) of the value of the investment made by the Financial Institutions and other institutions authorized to operate by the Central Bank of Brazil in a controlled company domiciled abroad shall be gradually computed in the tax basis of the IRPJ/CSLL of the controlling company domiciled in Brazil. For such, the following proportion shall be observed: 50% (fifty percent) in fiscal year 2021; and 100% (one hundred percent) as of fiscal year 2022.

In addition, the MP established that the provisions in Articles 3 to 9 of Law no. 12,838/2013, which deal with the presumptive credit computed based on credits arising from temporary differences originating from provisions for doubtful credits of Financial Institutions in bankruptcy or extrajudicial liquidation, when referring to the balance of credits originating from tax losses for IRPJ purposes and the negative basis of CSLL arising from exchange risk hedge transactions of the investment in a controlled company domiciled abroad, will only be applied until December 31, 2022.

Customs Measures:

- Prior Authorization for ExportIn order to guarantee national supply as a priority, ANVISA's prior authorization is now required for the export of goods and products subject to sanitary surveillance of the class of sanitizing agents and health products listed in Resolution RDC No. 352/2020, subsequently amended by Resolution RDC No. 370/2020.

- Certificate of Origin of GoodsDue to the pandemic, the IN RFB No. 680/2006 was recently amended by IN RFB No. 1936/2020 and now provides that the Certificate of Origin of Imported Goods may be submitted within 60 (sixty) days from the registration of the Import Declaration ("DI"), provided that the requirements of the standard are met and while the situation of emergency, state of public calamity or pandemic declared by the World Health Organization (WHO), recognized by the competent authorities. In addition, no guarantee will be required for customs clearance of the goods.

- Simplified Customs Clearance: Ordinance No. 601/2020 created the Customs Operational Center for Crisis Management generated by the Pandemic Coronavirus Disease 2019 (Cogec-Covid-19), in order to promote the institutional articulation of the RFB to enable and monitor customs activities necessary to meet the demands of society arising from this disease.

Among the measures adopted so far, the customs clearance of medical-hospital products and products to combat Coronavirus listed in CAMEX Resolution 17/2020 (and subsequent resolutions) and SRF Normative Instruction 680/2006 was simplified, and the receipt of the goods is now authorized even before the conclusion of the customs conference.

IN RFB no. 1,936/2020, in addition to establishing a new deadline for the presentation of the Certificate of Origin of Goods previously mentioned, also added some goods to the list of products with simplified customs clearance dealt with in Attachment II of IN RFB no. 680/2006 mentioned above. Among the items are medicines, machinery, items for production and maintenance of medical and hospital equipment, among other useful items to combat the Coronavirus pandemic.

Subsequently, Annex II of IN 680/2006 was again amended by IN 1,944/2020, which fully replaced it.

In addition, imports of Coronavirus in vitro diagnostic products may be made through the Import Licensing (SISCOMEX) and Express Shipping modes, as provided for in Resolution RDC No. 366/2020, upon presentation of the documents provided for in the Resolution. Thus, the analysis of imports will be prioritized by Anvisa.

The Federal Government also suspended, until September 30, 2020, the antidumping duties applied to Brazilian imports of disposable syringes for general use, as per CAMEX Resolution No. 23/2020, originating in China, and to Brazilian imports of plastic tubes for vacuum blood collection, originating in Germany, China, the United States and the United Kingdom.

- AEO - Compliance Level 2IN SRF No 680/2006 also had the change promoted by IN No 1,927/2020 which included the importer certified as an AEO (Authorized Economic Operator) in the mode AEO - Compliance Level 2 in the list of persons authorized to receive the goods before the conclusion of the customs conference.

- Export ProhibitionIn a slightly more restrictive measure, the Federal Government chose to ban the exports of medical, hospital and hygiene products listed in Law No. 13.993/2020, essential to combat the Coronavirus epidemic in Brazil. The list includes PPE (Personal Protective Equipment), lung ventilators, monitors and hospital beds. The Executive Power can also include or exclude products from the prohibition list.

- Special Customs RegimesIN RFB n° 1.947/2020 established procedures and deadlines for formalization of requests for application and extinction of the application of special customs procedures due to the Coronavirus, such as: conditions for digital request of requests for application and extinction of the application of special customs procedures, suspension of deadlines for the practice of procedural acts, suspension of deadlines for return of goods with temporary departure and temporary waiver of conference of goods.

Social Security Measures:

- Annual bonusThe anticipation of the payment of the annual bonus referred to in article 40 of Law no. 8,213/1991 to the beneficiary of social security who, during 2020, has received sickness, accident aid or retirement, death pension or confinement aid was authorized. The advance payment will be made in two (2) installments, the 1st (first) installment in April and the 2nd (second) installment in May 2020, as provided for in Provisional Measure (MP) No. 927/2020.

- FGTSThe deadline for companies to pay their employees' FGTS of March, April and May 2020 was suspended for 3 (three) months. Therefore, the FGTS that would fall due in April, May and June 2020 will become due monthly as of July 2020, and may also be paid in installments, in up to 6 (six) installments, without charges, in accordance with the provisions of Provisional Measure no. 927/2020.

In addition, MP no. 946/2020 extinguished the PIS/PASEP Fund, transferring the amounts to the FGTS to enable their withdrawal. According to the MP, the FGTS linked account holders, as of June 15, 2020 and until December 31, 2020, may make a withdrawal up to the limit of R$ 1,045.00 (one thousand and forty-five reais).

- INSS CompaniesThe social security contributions, in sum, INSS-Company, INSS-Agroindustry, INSS-Gross Revenue, INSS-Net Profit, INSS-Rural Employer, INSS-Special Insured, RAT/FAP, dealt with in Articles 22, 22-A and 25 of Law no. 8.212/1991, due by the companies, related to March and April of 2020, must be paid within the due date of the contributions due in July and September of 2020, respectively, as authorized by ME Ordinance 139/2020, as amended by ME Ordinance 150/2020.

- INSS Domestic EmployeeME Ordinance No. 139/2020, as amended by ME Ordinance No. 150/2020, has also determined that the social security contribution dealt with in article 24 of Law 8212 of 1991, owed by the domestic employer with respect to the contributions due in the months of March and April of 2020, must be paid within the due date of the contributions due in the months of July and September of 2020, respectively.

- INSS Retirees and PensionersThe 1st (first) installment was anticipated to April 2020, and the payment must occur between April 24th and May 8th. The 2nd (second) installment was anticipated to May 2020, and the payment must occur between May 25th and June 5th.

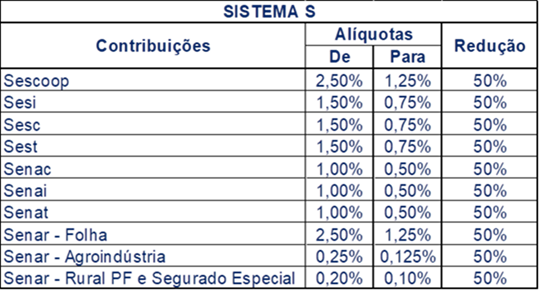

- System SMP no. 932/2020 reduced the rates of the S System contributions by 50% (fifty percent) until June 30, 2020. See the variation in the table below:

MP no. 932/2020 was unsatisfactorily received by the beneficiaries of the S System and is currently the object of ongoing lawsuits. The effects of the MP, which reduces the System S rates by 50%, were suspended by an injunction decision issued by the Federal Regional Court ("TRF") of the 1st Region, but this decision was suspended by the Federal Supreme Court ("STF"), therefore, MP no. 932/2020 remains in force and producing effects. We continue to monitor the evolution of the ongoing lawsuits.