The Central Bank approved, through Resolution 30 of, 29.10.2020, the Pix Collection and the integration to the receiving users, such as commercial establishments and companies, through the API Pix, new features of Pix.

In Pix Collection, retailers, suppliers, service providers and other entrepreneurs can issue a QR Code to make immediate payments, at points of sale or e-commerce, for example, or charges due at a future date. In this case, it is possible to configure other information besides the amount, such as interest, fine, discounts. It is a functionality similar to what happens today with boleto.

The API Pix, in turn, refers to the adoption of an application programming interface (API) standardized by the Central Bank, to provide an integration service to users. The goal is to bring greater ease for entrepreneurs to choose where to keep their account and more efficiency for software houses to promote the integration of Pix to their systems. The API Pix includes features for creating and managing collections, verification of settlement, reconciliation and support for return processes.

Furthermore, BCB Resolution 31 of October 29, 20 brought provisions on penalties to participants.

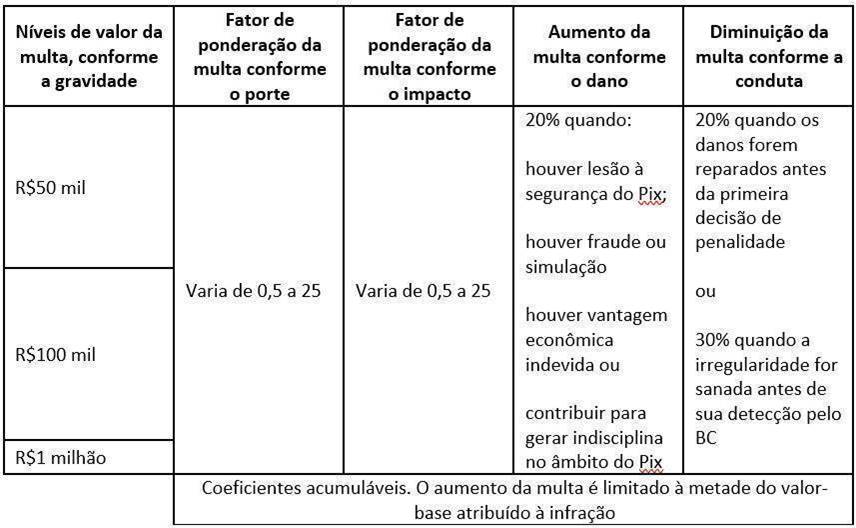

The institutions participating or in the process of adhering to Pix are subject to fines and other penalties arising from violations committed in the arrangement. The fines vary from R$50,000 to R$1 million, and may increase or decrease according to the economic capacity of the offender and the percentage of its participation in the total transactions of the arrangement. The Central Bank may impose penalties of suspension or exclusion of the participant in more serious situations.

Check the table BT BCB Resolutions here.