Considering the effects of the new coronavirus on the Capital Markets and its participants, the Brazilian Securities Commission ("CVM"), through Resolution No. 848 published on March 25, 2020, amended and/or suspended regulatory deadlines as described below:

Sanctioning Administrative Proceedings ("PAS")

Suspension of procedural deadlines running against the accused in PAS.

Installments

Postponement to July 31, 2020 of the due date for installment payments deferred under CVM Resolution 447/02, which were due on March 31, 2020.

Posting Notifications

Suspension until 31.07.2020 of the issuance of assessment notices, except to avoid expiry or prescription of the tax credit.

Restricted Efforts Public Offerings - ICVM 476

Suspension for 4 months of the effectiveness of article 9 of ICVM 476, which deals with the term between public offerings by the same issuer.

Promissory Notes - ICVM 566

Suspension for 4 months of the effectiveness of the sole paragraph of article 6 of ICVM 566, which deals with the filing, with the commercial registries, of the corporate act authorizing the issue of promissory notes.

Terms of Commitment

Postponement, for 120 days, of the maturity of obligations assumed under Commitment Terms entered into by the CVM that have not been settled and whose maturity has not yet occurred until the date of publication of Resolution 848.

This postponement did not apply to retirement obligations. In addition, the CVM maintained any monetary restatement provided for in each Commitment Agreement.

Financial Statements

Extension for 30 days, starting March 25, 2020, of the deadline for submitting the audited financial statements of investment funds, as well as of the separate assets of CRI and/or CRA issued by securitization companies.

Furthermore, the deadlines for holding the general meetings of investment funds to resolve on the accounts of the funds and their financial statements are also extended, as described below.

Extended Deadlines

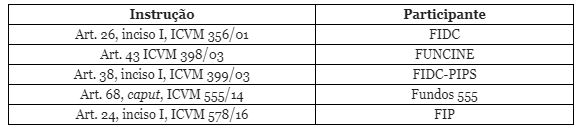

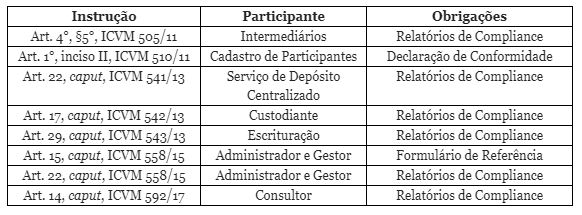

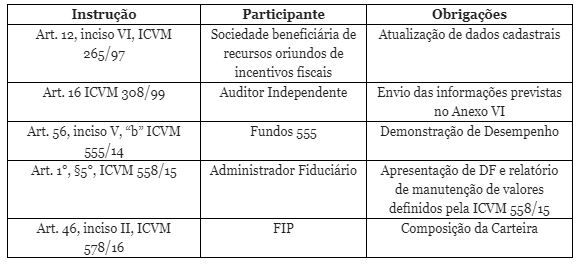

The deadlines listed below, which are scheduled to expire or which will commence while the state of emergency persists, are extended for 3 months:

- General Meeting to resolve on the financial statements

- Reference Form / Compliance Reports / Electronic Declaration of Compliance

- Other extended obligations

Double Deadlines

The time limits listed below, which are scheduled to expire or which will commence while the state of emergency persists, must be considered in double:

- FIDC - ICVM 356/01

(i) period of 30 days for the communication of alterations of the fund regulations arising from norms or from determinations of the CVM (sole paragraph of art. 26);

(ii) period of 90 days counted from the beginning of the activities of the fund for the minimum allocation of 50% in credit rights(caput of Art. 40);

(iii) period of up to 10 days after the closing of the month to send the information related to the number and value of the quotas, profitability and behavior of the portfolio of the fund(caption of Art. 47)

(iv) a maximum period of 10 days for sending to the CVM the documents of the fund when there is a change in the regulations, substitution of the administrator, incorporation, spin-off, merger and/or liquidation(caption of art. 57); and

(v) a period of 15 days for cancellation of the fund registration (sole paragraph of art. 57-A).

- Intermediaries - ICVM 510/11

(i) The period of up to 7 business days for updating the registration form, as set forth in item I of article 1 of ICVM 510/11.

- Liquid Funds - ICVM 555/14

(i) item II of Paragraph 2 and Paragraphs 3 and 8 of Article 22, as well as Paragraph 1 of Article 24, related to the distribution of closed-end funds as set forth

(ii) term for sending the subscription list pursuant to the caption sentence of art. 26

(iii) communication of the date of the first payment in full of shares of the fund pursuant to the caption sentence of art. 28

(iv) in the terms of § 2 of Art. 39, the period related to the closing of the fund;

(v) the period of communication, to the quota holders, of the alteration of the regulations when resulting from an act of the administrator in terms of § 1 of Art. 47

(vi) the period for sending the periodic information stipulated in clause II of Art. 59

(vii) period for calling a general meeting on the initiative of the manager, custodian or quota holders pursuant to the sole paragraph of art. 69;

(viii) term for the quota holders' manifestation when made by consultation pursuant to Paragraph 2 of art. 71;

(ix) as per the caput of art. 77, the term for sending a summary of the decisions taken in the meeting;

(x) the deadlines related to waiver or de-accreditation set forth in the main section and Paragraph 1 of art. 94;

(xi) pursuant to the caption sentence and § 1 of article 105, the time limits in the event of passive delisting;

(xii) requests for reimbursement resulting from the provision in § 2 of art. 134

(xiii) average net worth term pursuant to the caption sentence of art. 138

(xiv) time limits related to the liquidation of the fund pursuant to the caption sentence and Paragraph 6 of Art. 139; and

(xv) time limits related to the closing of the fund pursuant to the caption sentence and sole paragraph of art. 140.

- Other Instructions that also had deadlines doubled were:

(i) FII - sole paragraph of art. 4, § 1 of art. 17-A, § 1 of art. 26-A, items I and VII of art. 39, items II and VII of art. 41, and item I of art. 51 of ICVM 472/08;

(ii) FIP - Paragraph 5 of Article 11, Paragraph 1 of Article 25, main section of Article 42, item I of Article 52 of ICVM 578/16;

(iii) Mutual Privatization Funds (FGTS) - Article 30-B, items II, III and IV, Article 31 and Article 33 of ICVM 279/98;

(iv) Investment Clubs - FGTS - art. 28, caput of art. 28 and sole paragraph of art. 28 of ICVM 280/98;

(v) Index Funds - sole paragraph of art. 31, sole paragraph of art. 34, caption and § 4 of art. 35, item II, "b", of art. 43, § 4 of art. 58, caption and sole paragraph of art. 68, caption of art. 69, caption and sole paragraph of art. 70 of ICVM 359/02;

(vi) FUNCINE - § 1º of art. 28, caput of art. 29, sole paragraph of art. 39, caput of art. 85 and caput and of art. 87 of ICVM 398/03;

(vii) FIDC-PIPS - caput of art. 17, sole paragraph of art. 32, caput of art. 37, § 1 of art. 38, sole paragraph of art. 40, caput of art. 42, § 1 of art. 50, caput of art. 62, caput of art. 64, item I of art. 65 and caput of art. 73 of ICVM 399/03;

(viii) CEPAC - item I of Article 7 of ICVM 401/03;

(ix) FAPI - paragraphs 2 and 3 of art. 2 and items II, III and IV of art. 3 of ICVM 423/05;

(x) Workers' Severance Indemnity Fund - main section of Article 36 of ICVM 462/07;

(xi) Submission of funds' information to SCR - sole paragraph of art. 2 of ICVM 504/11;

(xii) Promissory Note - items I and II of article 14 of ICVM 560/15; and

(xiii) Appeals to the Collegiate resulting from decisions of the Superintendents - items I and IX-A of CVM Resolution 463/03.

PLDFT - ICVM 617

CVM extended, to October 1, 2020, the end of the vacancy period for the entry into force of the provisions not yet in force of ICVM 617, which deals with the prevention of money laundering and terrorism financing.

Finally, CVM stresses that such resolution does not contemplate the deadlines set by law or related to legal deadlines that cannot be changed by CVM regulation, such as, but not limited to (i) ordinary general meetings of publicly-held companies; and (ii) deadlines set forth in the Corporation Law for preparation and disclosure of financial statements.

To access the full text of Resolution 848, published by CVM, click here.

The Capital Markets team is available for any clarifications and/or additional information by e-mail mercadodecapitais@btlaw.com.br