The Federal Government has adopted several measures in the tax, customs and social security spheres to reduce the economic impacts of the C Coronavirus to Brazil. These acts are periodically updated and summarized by our tax team.

See below our summary of the Tax, Customs and Social Security measures, divided into topics:

Tax Measures:

- Presentation of Documents: The Normative Instruction (IN) of the Federal Revenue of Brazil (RFB) n° 1.931/2020 suspended, until May 29, 2020, the need for taxpayers to submit original documents or certified copies for the request of services with the RFB. Documents in plain copy or electronic copy obtained by means of scanning will now be temporarily accepted, in view of the fact that the services at the RFB's premises are reduced, being carried out primarily by virtual means.

- Debt Clearance Certificates: the RFB and the Attorney General Office of the National Treasury (PGFN), via Joint Ordinance RFB and PGFN No. 555/2020, extended the validity of the Debt Clearance Certificates related to Federal Tax Credits and Federal Outstanding Debt (CND) and of the Positive Certificates with Negative Effects of Debts related to Federal Tax Credits and Federal Outstanding Debt (CPEND) for 90 (ninety) days.

- Collection of Tax Debts: the RFB determined the suspension, until May 29, 2020, of electronic notices of collection and summons to pay taxes through Ordinance RFB no. 543/2020. Likewise, the PGFN, through Ordinance of the Ministry of Economy (ME) no. 103/2020, also suspended collection acts and forwarding of overdue debt certificates for extrajudicial protest for the next 90 (ninety) days. These suspensions also apply to social security debts.

- Income Tax ReturnThe deadline for filing the Individual Income Tax Return, previously set for April 30, 2020, has been postponed to June 30, 2020. The concession of 2 (two) more months given by IN no. 1924/2020 came in attention to the taxpayers' reports regarding difficulties in obtaining their Income Tax Returns during the crisis installed by the Coronavirus.

- Import Tax: the Federal Government has authorized the reduction to 0 (zero) of the ad valorem Import Tax rates, until September 2020, on the import of medical-hospital products listed in CAMEX Resolution No. 17/2020 and CAMEX Resolution No. 22/2020.

- IOF-CreditThe IOF-Credit rates applicable to transactions entered into between April 3, 2020 and July 3, 2020 related to loans, opening of credit, discounts, including sales to factoring companies of credit rights arising from installment sales, advances to depositors, financing and excesses of credit limits referred to in items I, II, III, IV, V, VI and VII of the heading and in §15 of Art. 7 of Decree no. 6306/2007, as well as the additional IOF rate dealt with in §5 of Art. 8 of said rule. This change was promoted by Decree 10305/2020, which also established the same reduction for new incidences of IOF-Credit on these transactions and on transactions not settled on the due date referred to in paragraph 2 of Art. 7 of Decree 63306/2007.

- IPI: The Federal Government has also authorized the reduction to 0 (zero) of the IPI rates, until September 2020, for domestically produced or imported goods listed in Decrees Nos. 10,285/2020 and 10,302/2020.

- Administrative Proceedings: Pursuant to Ordinance ME No. 103/2020 and RFB Ordinance No. 543/2020, the terms for taxpayers' defense in administrative proceedings for collection of the federal overdue liabilities, including social security debts, were suspended for ninety (90) days, and the terms for practice of procedural acts within the scope of the RFB and for the RFB to issue electronic decision-making orders with analysis of merit in requests for refund, reimbursement and reimbursement, and offsetting statements were suspended until May 29, 2020.

In addition, Ordinance PGFN no. 7.821/2020 also suspended for ninety (90) days the deadlines for the filing, opposition and appeal against the decision rendered in the scope of the Administrative Procedure for the Recognition of Liability (PARR), for the filing of a statement of non-compliance and appeal in the scope of the exclusion process of the Special Program of Tax Regularization (PERT), for the early offer of guarantee in tax enforcement, for the filing and appeal against the dismissal of the Request for the Review of Enrolled Debt (PRDI) and for the filing for protest of overdue debt certificates.

- Renegotiation of Debts: until March 25, 2020, the PGFN, through Ordinance ME No. 103/2020, opened the possibility of renegotiating debts recorded in the federal active debt, including social security debts, through a transaction by adhesion on the REGULARIZE platform(www.regularize.pgfn.gov.br).

The adhesion presupposes the payment of an down payment of at least 1% (one percent) of the total value of the debt in up to 3 (three) installments, as well as the payment of the remaining debt in up to 81 (eighty-one) installments for legal entities or 97 (ninety-seven) installments for natural persons, individual entrepreneurs, micro-companies (ME) or small-sized companies (EPP), the first payment of the other installments being postponed to the last business day of the month of June 2020. For social contributions, there is a limitation of fifty-seven (57) installments. For adhesion, the conditions and limits established in Provisional Measure no. 899/2019 and by ME/PGFN Ordinance no. 7,820/2020 must be observed.

- Simples Nacional: an extension of the deadline for companies that joined Simples Nacional to pay the next installments of federal taxes was established. Thus, payments due in April, May and June 2020 were extended to October, November and December 2020, as set forth in Resolution no. 152/2020 of the Management Committee of Simples Nacional (CGSN).

- Taxation of the Exchange Variation of Hedge for Financial InstitutionsMP no. 930/2020 established that, as of 2021, the exchange variation of the portion with risk coverage (hedge) of the value of the investment made by the Financial Institutions and other institutions authorized to operate by the Central Bank of Brazil in a controlled company domiciled abroad shall be gradually computed in the tax basis of the IRPJ/CSLL of the controlling company domiciled in Brazil. For such, the following proportion shall be observed: 50% (fifty percent) in fiscal year 2021; and 100% (one hundred percent) as of fiscal year 2022.

In addition, the MP established that the provisions in Articles 3 to 9 of Law no. 12,838/2013, which deal with the presumptive credit computed based on credits arising from temporary differences originating from provisions for doubtful credits of Financial Institutions in bankruptcy or extrajudicial liquidation, when referring to the balance of credits originating from tax losses for IRPJ purposes and the negative basis of CSLL arising from exchange risk hedge transactions of the investment in a controlled company domiciled abroad, will only be applied until December 31, 2022.

Customs Measures:

- Prior Authorization for Export: to ensure the national supply as a priority, a prior authorization from ANVISA is now required for export of goods and products subject to sanitary surveillance of the class of sanitizers and health products listed in Resolution RDC No. 352/2020, as well as chloroquine and hydroxychloroquine and some of their derivatives.

- Simplified Customs Clearance: Ordinance 601/2020 created the Customs Operational Center for Crisis Management generated by the Pandemic Coronavirus Disease 2019 (Cogec-Covid-19), in order to promote the institutional articulation of the RFB to enable and monitor customs activities necessary for the demands of society arising from this disease.

Among the measures adopted so far, the customs clearance of products for medical and hospital use and to combat the Coronavirus listed in CAMEX Resolution 17/2020 and SRF Normative Instruction 680/2006 was simplified, and the receipt of the goods is now authorized even before the conclusion of the customs conference.

In addition, imports of Coronavirus in vitro diagnostic products may be made through the Import Licensing (SISCOMEX) and Express Shipping modes, as provided for in Resolution RDC No. 366/2020, upon presentation of the documents provided for in the Resolution. Thus, the analysis of imports will be prioritized by Anvisa.

The Federal Government also suspended, until September 30, 2020, the antidumping duties applied to Brazilian imports of disposable syringes for general use, as per CAMEX Resolution No. 23/2020, originating in China, and to Brazilian imports of plastic tubes for vacuum blood collection, originating in Germany, China, the United States and the United Kingdom.

- AEO - Conformity Level 2: IN SRF No 680/2006 also had the change promoted by IN No 1,927/2020 which included the importer certified as an Authorized Economic Operator (AEO) in the mode AEO - Conformity Level 2 in the list of persons authorized to receive the goods before the conclusion of the customs conference.

Social Security Measures:

- Annual Allowance: the advance payment of the annual allowance referred to in article 40 of Law no. 8,213/1991 to the beneficiary of social security who, during this year of 2020, has received sick pay, accident allowance or retirement, death pension or confinement allowance was authorized. The advance payment will be made in two (2) installments, the 1st (first) installment in April and the 2nd (second) installment in May 2020, as set forth in Provisional Measure (MP) no. 927/2020.

- FGTS: the deadline for companies to pay their employees' FGTS of March, April and May 2020 was suspended for three (3) months. Thus, the FGTS that would fall due in April, May and June 2020 will now fall due monthly as of July 2020, and may also be paid in installments, in up to 6 (six) installments, without charges, in accordance with the provisions of MP no. 927/2020.

- INSS: the anticipation of the payment of the 13th salary of retirees and pensioners of the INSS was also authorized, with the 1st (first) installment anticipated to April 2020, whose payment must occur between April 24 and May 8, and the 2nd (second) installment was anticipated to May 2020, and the payment must occur between May 25 and June 5.

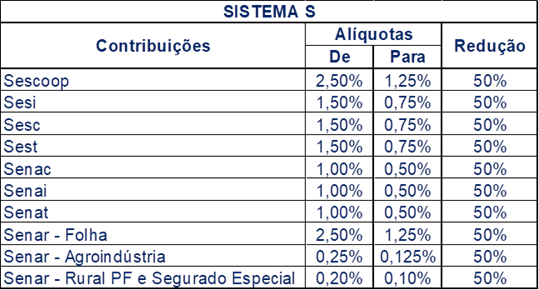

- System SMP no. 932/2020 reduced the rates of the S System contributions by 50% (fifty percent) until June 30, 2020. See the variation in the table below:

For further information, contact the Advisory Tax team (tributarioconsultivo@btlaw.